Helping to connect you with the right PEO choice for the success of your business.

Request a Quote

Fill out the information below and we will get back to you with the information you need.

Contact Us

Payroll & Taxes

- W-2's

- On-time State and Federal employment tax filings

- Payroll checks & direct deposits

- Process garishment, child support, etc.

- Payroll submission via phone, fax or online

Human Resources

- Employee handbook & job descriptions

- Assist with SUTA claims & hearings

- Provide HR consulting via phone/on-site

- Compliance assistance-FMLA/COBRA/etc

- HR forms & employment paperwork

Workers Compensation

- NO DEPOSITS - NO AUDITS

- Pay as you go

- Manage claims & return to

work programs - Worksite safety programs

- OSHA compliance management

Employee Benefits

- Provide access to health or administer plan

- Dental & Life insurance plans

- 401 (k) retirement plans

- Section 125 Flexible benefit plans

How Propay Can Help You?

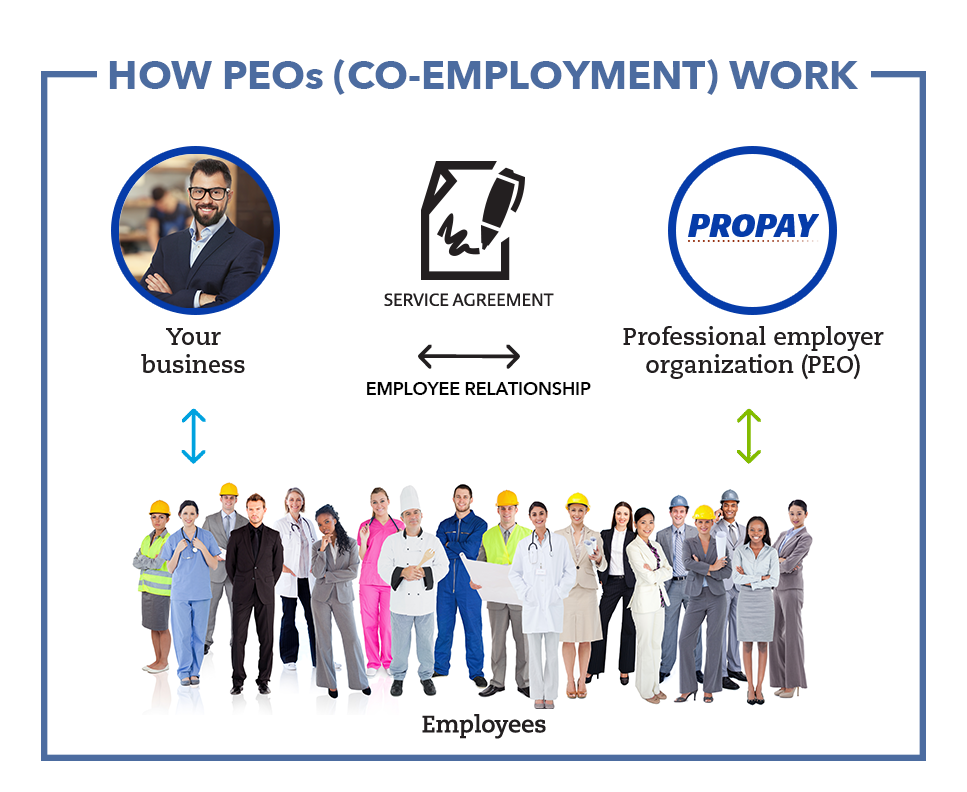

PEO's are co-employers. They work by assuming some of the employer risks and responsibilities for your employees.

Propay will lease those same employees back to your business while administering some or all of the employee benefits, human resource services, risk management, payroll, tax administration and workers' compensation insurance.

Employees have access to benefits such as group health, 401(K) plans, cafeteria 125 plans, life and dental insurance options. ProPay and many other PEO's offer even more value added benefits and services to help you and your employees succeed.

Featured Cars

This is a Title

$10,600.00

This is a Title

$10,600.00

This is a Title

$10,600.00

Newly Release Car

PEO Defined

PEOs are co-employers

The Professional Employer Organization relationship involves a contractual allocation and sharing of employer responsibilities between the PEO and the client; this shared employment relationship is called co-employment.

When evaluating the employer role of either the PEO or the client, the facts and circumstances of each employer's obligation should be examined separately, since neither party alone is responsible for performing all of the obligations of employment. Each party will be solely responsible for certain obligations of employment, while both parties will share responsibility for other obligations. When the facts and circumstances of a PEO arrangement are examined appropriately, both the PEO and the client will be found to be an employer for some purposes, but neither party will be found to be "the" employer for all purposes.

Both the PEO and the client company establish common law employment realtionships with worksite employees. Each entity has a right to independently decide whether to hire or discharge an employee. Each entity has a right to direct and control worksite employees - the PEO directs and controls worksite employees in matters involving human resource management and compliance with employment laws, and the client company directs and controls worksite employees in manufacturing, production, and delivery of its products and services.

Our Blog

This is a text area for titles